Always talk to your tax adviser or maybe the IRS To learn more about how you can assert charitable deductions. The IRS can response your tax issues and can provide tax types, publications, and other looking at products for further more aid.

To start out, discover a chapter near you that accepts vehicle donations, complete its sort with the Speak to and motor vehicle specifics, and organize a get.

You may think of one's motor vehicle as practically nothing much more than a “junk auto”, but to the “would like Youngsters” of Make-A-Desire, your donation can provide them with a existence-changing encounter. Be part of others with your Group who happen to be donating their autos to profit youngsters who would like to Stay their dreams.

Our partners at Superior Remarketing Services return a better share than every other vehicle processing entity. On the month-to-month foundation, in between eighty four% and 87% in the gross income created from motor vehicle profits comes to Habitat for Humanity.

When your title is obtained and your car or truck is picked up, you will be not accountable for the automobile.

Irrespective of what your vehicle sells for, the IRS helps you to claim approximately $500. Your Donate Vehicle To Veterans receipt is all that is needed to declare your noncash donation.

The charity donates or sells the car to an individual in need for an extremely minimal (beneath sector) selling price for the objective of assisting them with transportation.

Previous to January 2005, the IRS was allowing for folks who donated to a certified auto donation system to take a tax deduction dependent on their car or truck's current market worth Irrespective of how A great deal or how tiny the car or truck offered for. Figuring out the marketplace price of a donated car or truck is commonly charity car donation pretty complicated and time-consuming, which made perseverance of the quantity of the tax deduction baffling.

If your car is brand new, click here damaged down, aged, or simply simple junky you can even now get a tax deduction after you donate your vehicle to Wheels For Needs.

Increase your tax deduction these days by beginning your on the web motor vehicle donation sort and create a difference in a toddler’s daily life. It will eventually get a lot get more info less than a minute to fill out the donation variety plus a agent can get in touch with you in a lot less than 24 several hours of ending the shape.

She began as a freelance author, researcher and translator right before reporting pension investments at Typical & Very poor’s Money IQ. She Sophisticated to include all factors personal finance at LendingTree, in which she grew to become an in-dwelling professional and made consumer guides on charity car donation subjects from automobile buying to household refinance and how to select the most effective financial institution accounts.

Luckily, due to The brand new tax regulation that went into outcome in January 2005, the IRS has taken the guesswork outside of determining the value of one's donated auto, truck, RV, boat or other auto.

The automobile does not have for being registered during the donor’s name. Even so, the individual whose name is on the title will have to indicator the title or fill out supplemental paperwork.

What styles of autos does Cars for Properties take? Don’t let the identify fool you. We take in many different automobile donations here that roll and float, even should they are retired from use. Find out more

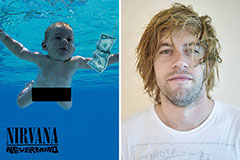

Spencer Elden Then & Now!

Spencer Elden Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!